Today, rupee reached a fresh record

low of 65.5, falling almost 23% in past four months or say almost 45% in last 2

years. This makes me think that people who have bought properties or

planning to buy one in the near future would surely want to know its effect on

real estate. Is this the right time to spend all those life savings into buying

property. If yes, then which location would make more sense right now? Let us

understand what has happened to rupee and how it affects the real estate

market. But before, it is quite interesting to know rupee more closely.

History of Rupee

It was only the day we got

independence that Indian rupee could match the dollar value, when $1 was equal

to Re. 1. At that time, rupee was linked to pound and the country had no external

borrowings.

With the introduction of first Five

Year Plan, government borrowed from outside and as a result we see Maharatnas

such as SAIL etc. (Though when we look in hindsight, it’s hard to find any

recent industries of such scale set up by the government. Anyways, that’s

another discussion all together. )

Post-independence, India followed a

fixed rate regime between till year 1966 when $1 = Rs. 4.79. The two wars with

China and Pakistan in year 1962 and 1965 resulted in huge budget deficit. The

government was forced to devalue Indian currency and $1 = Rs. 7.57. In 1971,

government linked rupee to dollar.

1973

|

7.66

|

1983

|

10.11

|

1993

|

31.26

|

2003

|

46.60

|

1974

|

8.03

|

1984

|

11.36

|

1994

|

31.39

|

2004

|

45.28

|

1975

|

8.41

|

1985

|

12.34

|

1995

|

32.43

|

2005

|

44.01

|

1976

|

8.97

|

1986

|

12.60

|

1996

|

35.52

|

2006

|

45.17

|

1977

|

8.77

|

1987

|

12.95

|

1997

|

36.36

|

2007

|

41.20

|

1978

|

8.20

|

1988

|

13.91

|

1998

|

41.33

|

2008

|

43.41

|

1979

|

8.16

|

1989

|

16.21

|

1999

|

43.12

|

2009

|

48.32

|

1980

|

7.89

|

1990

|

17.50

|

2000

|

45.00

|

2010

|

45.65

|

1981

|

8.68

|

1991

|

22.72

|

2001

|

47.23

|

2011

|

46.61

|

1982

|

9.48

|

1992

|

28.14

|

2002

|

48.62

|

2012

|

53.34

|

Table: Average annual exchange rates of India from 1973 to 2012

Then comes 1991, when India suffered

low growth and high inflation. Even forex reserves had dwindled to such an

extent that the country couldn’t afford three weeks of imports. As a result,

rupee was devalued to 17.90 against a dollar.

In 1993, government switched to a

free-floating currency. The exchange rate would now be determined by the market

based on supply and demand. In a free-floating currency, government intervenes

only when it feels the dire need to control the volatility. High volatility in

the currency rate can prove detrimental to a country. Rupee got devalued to

31.37 against a dollar.

|

| Average annual exchange rates - USD/INR |

Major factors that affect currency exchange rates?

High inflation: Every developing economy withstands high inflation.

Reason being that a developing economy is one where large investments are made

that leads to high growth rate. Large investments lead to large inflow of money

in the economy thereby increasing the money supply. And we know that increased

money supply will lead to increase in demand, thereby causing inflation. If the

purchasing power parity has to hold good, the rupee has to adjust to the change

in inflation against dollar. Let us take an example to explain this purchasing

power theory and inflation. Let say the price of 1 kg rice on India is Rs. 50.

The same is available in U.S. for $1. Inflation in India is 10% whereas in U.S.

it is 2% per annum. So after a year, the rice would cost Rs. 55 in India and

$1.02 in U.S. As a result the new exchange rate would be 55/1.02 = 53.92. During

high inflation, depreciation of currency is quite natural.

High Trade deficit: Trade deficit is another reason contributing to rupee

depreciation. High current account deficit wherein imports are greater than

exports leading to trade deficit for India leads to increasing demand for

dollar for imports. As demand for dollar rises, its value appreciates and the

rupee depreciates.

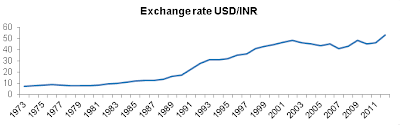

FDIs and FIIs: These are the medium through which dollar flows into

the Indian economy. As FDIs and FIIs decreases, the value of Indian currency

depreciates. As you can see in the graph above, Rupee has appreciated in the

period between 2002 and 2007 primarily because of this reason.

Effect of exchange rate on Indian real estate

When rupee depreciates, it is

likely to increase Real estate demands amongst the NRIs. This would lead to increase in demand by the NRIs which should lead to rise in prices. but there are other factors too.

In the short run, this depreciating

rupee will not affect the real estate prices in India. But a sustained

depreciation of rupee will eventually lead to prices becoming dearer for buyers.

Reason being that Indian economy is more import based with a trade deficit. As

a result of rupee depreciation, Indians will have to pay out more for imported

goods thereby decreasing there disposable income and making houses less affordable. Also, when inflation rises, central bank (RBI) increase the

interest rates and tighten the economy thereby making home loans dearer. This will lead to decrease in demand by local buyers thereby putting a pressure on Real estate developers to reduce prices. On the other hand, inflation in construction material costs will lead to rise in construction costs. Thus, companies will turn out to be major losers in this scenario of increasing depreciation.

History teaches us the best. When

Argentina converted its fixed currency regime to a floating currency regime,

its value depreciated by as much as 66% in a few months compared to dollar. But

Real estate prices in superior locations did not fall that much. Scarcity of

financing did not hinder the market as much as anticipated. A substantial

change in the profile of buyers occurred, from home-owners to non-resident

Investors. If one measured the market in pesos (the Argentine currency) it

generally went up and devaluation benefited the real estate market—if measured

in foreign currency (assets in euros or dollars)—depreciated, but not in

proportion to the Argentine currency devaluation. ( Devaluation and Real Estate

values: The Argentine case by ARQ.

JOSÉ R. ROZADOS, ARQ. GERMÁN GÓMEZ PICASSO, AND RICARDO ULIVI, PH.D.)

Advice for home buyers

One can buy homes in IT hubs or

rather export hubs of the country. Bangalore, Pune and Hyderabad make sense to

me personally. Or else, the best and riskless strategy for investors is to wait

and watch till the currency becomes less volatile. But then we know that there

is “no risk, no gain”. J

Would request you to enter your email address in the right side bar of this page under "follow by email" to get a regular update of my articles. "Knowledge is the food for the brain"