Source: The Economic Times,23 October 2013,Bangalore

Bangalore has emerged as the hottest business destination in the country leaving behind bigger cities like Mumbai, Delhi and Chennai, says a recent survey by Global Initiative for Restructuring Environment and Management (GIREM) and DTZ, the global leader in property services.

The report, which surveyed 21 business destinations across country, says good connectivity, high quality of talent pool, good availability of office space suiting different income groups, a high-quality education system and a welcoming, multifarious city culture has helped Bangalore notch the top slot. Bangalore ranks 1st with a total score of 129.56 out of 160 followed by Chennai at 127.84 and Mumbai at 123.64

"Bangalore has one of the highest footfalls of business travelers in the country, driven by the booming IT/ITes sector. It also has one of the most resilient real estate markets which offer commercial space at much more competitive rates compared to cities like Delhi, Mumbai or Gurgaon," says Shyam Sundar S Pani, President - GIREM.

According to the report, while popular destinations such as Bangalore, Mumbai, Chennai, and Pune continued to occupy top positions, the ranking revealed some unexpected contenders in the Top 10 league including Indore, Bhubaneshwar, Kochi, Coimbatore and Nagpur.

"Rapid and unplanned urbanization in the country over the past few decades has led to unprecedented job demand. Job creation is a crucial answer to this challenge which calls for the pressing need to develop new industrial townships and business districts to ease the pressure from the already saturated business destinations," says Anshul Jain, Chief Executive, DTZ.

Bangalore commercial space absorption that witnessed 105 million sft absorbed till date as compared to other top Indian cities led mainly by growth in leasing from IT/ITes firm, also helped fuelling growth in the residential real estate market.

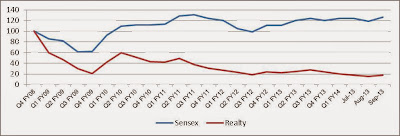

The residential market has seen absorption levels increasing by 22% in the first half of 2013 mainly driven by homes in the mid income group. In contrast other bigger markets like Mumbai and NCR, saw launches drop nearly 10%, in 2012 YoY while absorption levels have fallen close to 13% for the same period, as per Knight Frank latest report.

"Around 28,000 units were launched during H1 2013, with 53% of the units launched were priced under Rs 50 lakh. Majority of the demand came from IT/ITes segment," says Samantak Das, chief economist and director - research Knight Frank.

"We expect sales to remain on the same level as last year. The middle segments seem to be moving well in spite of current volatility in the economy," said Viswa Prathap Desu, vice president - sales & marketing Brigade Enterprises.

Another Bangalore-based builder, Sobha Developers sold property worth Rs 602.8 crore in the first quarter of FY 2014. ""We will not revisit sales target for the year and expect to sell 4.2 million sq ft of residential space for about Rs 2,600 crore in FY 2014," says vice-chairman and managing director, JC Sharma. The developer aims to add 8.9 million sq ft of new residential space this fiscal.

"We expect sales to remain on the same level as last year. The middle segments seem to be moving well in spite of current volatility in the economy," said Viswa Prathap Desu, vice president - sales & marketing Brigade Enterprises.

Another Bangalore-based builder, Sobha Developers sold property worth Rs 602.8 crore in the first quarter of FY 2014. ""We will not revisit sales target for the year and expect to sell 4.2 million sq ft of residential space for about Rs 2,600 crore in FY 2014," says vice-chairman and managing director, JC Sharma. The developer aims to add 8.9 million sq ft of new residential space this fiscal.

You can also read: Which city to invest in Real Estate Market : BullzBearz