|

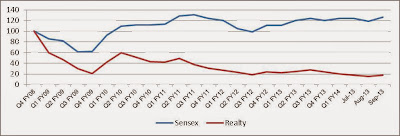

| BSE Sensex Vs. BSE Realty Index |

As we can see, BSE Realty Index

has fallen by almost 80% since Q4 FY08 whereas Sensex has risen by almost 20%

in the same period. And we all envy the fact that prices in real estate are

raising leaps and bound. There is no denying the fact that realty investments

is one of the major investments to have in one’s portfolio. The question is

“why are Realty stocks prices falling despite the magnificent rise in property

prices”? Is there a flaw in the strategies used by these real estate companies

which is not allowing these realty companies benefit from the rise in real

estate prices. Or is it that these real estate stocks are simply undervalued.

Now let us look at the consolidated revenue, EBITDA and PBTs

of the top real estate companies of India for FY13.

|

Company

|

Consolidated Turnover (in cr)

|

EBITDA (in cr)

|

PBT (in cr)

|

Finance Charges (in cr)

|

Interest / ebitda ratio

|

|

DLF

|

9095

|

3150

|

839

|

2314

|

73%

|

|

Oberoi

|

1147

|

712

|

683

|

37

|

5%

|

|

Prestige

|

2011

|

642

|

425

|

148

|

23%

|

|

Mahindra Lifespaces

|

772

|

276

|

136

|

31

|

11%

|

|

Unitech

|

1526

|

576

|

231

|

304

|

53%

|

|

GPL

|

1047

|

296

|

288

|

3

|

1%

|

|

IndiaBulls

|

1486

|

471

|

222

|

228

|

48%

|

|

Sobha Dev

|

2093

|

553

|

323

|

170

|

31%

|

The ratio of interest paid to

EBITDA is a clear indication that these companies shell out a major percentage

of their profits as interest on the loans taken. DLF, Indiabulls & Unitech shell

out more than 50% of their EBITDA as interests. Higher prices and profits in

real estate are obviously not accruing to the investors. No doubt, these

companies have to work at a very high IRR (Internal Rate of return) thereby

pricing their products at a very high end. I always wonder what if government

were to waiver their loans just as they did for farmers back in 2009 (to the

tune of Rs. 70,000 crore), will it promote lower prices for the properties!!

Though, I am personally against it.

But the whole point is that the

stock prices of these companies are not rising because they have to shell out a

hell lot of money as interest costs.

Secondly, almost all real estate

companies depend on PE investors who expects a return of 20-30% in a short span

of time. To accommodate for their margins, Real estate companies jack up their

prices so their own margins do not get hit. This leads to a further rise in

prices of real estate properties. Now at these jacked up prices, it is difficult

for end users to buy a property when it is still under construction. On the

other hand, investors with a large chunk of money buy these properties by

paying a small token money. As a result, when you see in Gurgaon, especially

the belt of Dwarka Expressway and New Gurgaon, almost all properties are

selling at phenomenal prices which is not supported by the infrastructure

development. Developers are increasing their prices without any logic, and

investors are still ready to buy. There is zero consumption by the end user.

Prices are rising based on speculation. The builders are forced to delay the

construction of these properties until there is some incentive in the form of

infrastructure that would enable resale to end users. This delay in

construction further jacks up the prices.

Sometimes I wonder, what is the

need of PE capitals in residential construction. Developers charge on the basis

of construction linked plan where a buyer has to pay based on the construction

done till then. This money is sufficient to sustain the construction

activities, nullifying the need for any PE investment. With margins for PE investments

gone, it should enable to bring down the prices considerably. This should in

turn help increase the end-consumer demand as well which is the need of the

hour.

We talk about corporate social

responsibility, what better than being responsible for this cause for any real

estate developer. Please give your thoughts!!

Find someone who can do our job well and take care of the things in our business. We have have to pull off our investment into how it can be better and make sure that it can be effective in the market. Always think of our business and give respect to our agents on what they can do for our Property Investment Portfolio to succeed.

ReplyDeletehttp://property-investment-portfolio.blogspot.com/2013/06/property-investment-points-to-consider.html