In the past 10 years

Hyderabad Real Estate has seen it all, from being an attractive destination for

IT/ITES services between 2000-2008 to being a victim of the Global Recession

between 2008-09 to political turmoil lurking there in the name of state

bifurcation since 2009. Hyderabad Realty witnessed attractive capital

appreciation in the period 2000-08. Over the past decade, Hyderabad has

eveolved from the commonly apprehended image of an under-developed tier-III

city into a vibrant city with thriving Business opportunity and a major centre

of employment. Most of the major Real estate destination of India has recovered

and recovered strong post-recession except for Hyderabad.

Andhra Pradesh has gone

on a shutdown mode with the latest being the strike in Vijayawada Thermal Power

station. The strike by the Anti-Telangana power sector has crippled

life in Andhra Pradesh badly hitting Hospitals and Power supply. This political

turmoil is badly hitting the growth of Realty in Hyderabad. The New Launches

are almost on a dry state and no capital appreciation can be seen. Work has

stopped on most of the undergoing construction due to political instability in

the region. But, there is a silver lining in every cloud.

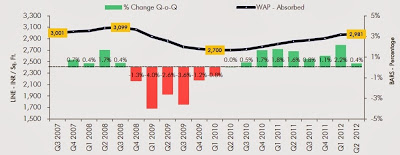

Residential weighted average

capital values escalated from approx. INR 1,000 per sq. ft. in the year 2000 to

INR 3,100 per sq. ft. by Q3 2008 exhibiting an annual appreciation of

approximately 15%.Post the slump triggered by the global financial crisis, the

city has failed to replicate the growth rate of pre 2008 years. The political

turmoil on Telangana issue could not have happened at a worse time for

Hyderabad real estate. The period after the year 2008 has been characterized

by fewer project launches and declining or at best stagnating capital

values.The weighted average capital value has witnessed a decline from INR

3,100 per sq. ft. in Q3 2008 to INR 2,980 per sq. ft. by the end of Q1 2012

exhibiting a negative annual return of 1.4%. (Source:Prop-Equity)

|

| HYDERABAD - Capital Value Trend |

People who couldn’t

afford to buy a house five years ago can find a house which is affordable and

at a preferred location now. The price/sqft of an apartment in the prime

locations of Hyderabad are comparable or in some cases lower than the price

existing in the peripheral locations of Navi Mumbai and Gurgaon. Doesn’t it

make sense to buy at such huge discounted prices!

Ofcourse, the risk still

prevails in Hyderabad Realty. But then, if it were not for this risk the prices

wouldn’t be so affordable now would it? The challenge is to keep a good track

of the political situation prevailing in Andhra Pradesh and to time your entry

well. The market well deserves to be at par with other prime residential

markets in the country. Once the situation gets better, there won’t be any

looking back for this city. To summarize, the long term opportunities outweighs

short term risks.

I appreciate your some line which has opened my both eye...Because i was going to invest on Hyderabad Property.

ReplyDeletepraneeth pranav valley bachupally

Thanks for the information you have provided. In present days, the demand for real estate properties has increased in Hyderabad and it is the best place for the investors to invest in real estate.

ReplyDeleteReal estate in Hyderabad

thanks for sharing the blog,very nice information provided regarding the real estate,and new constructions and new houses,villas ,plots details are here,I m so glad to see this blog,very innovative description about the real estate,good description Villas in Hyderabad

ReplyDeleteThank you very much for sharing this information with us and some of my doubts are clear by reading your article Hyderabad Flats for Sale

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteThanks for the information you have provided. In present days, the demand for real estate properties has increased in Hyderabad and it is the best place for the investors to invest in real estate.

ReplyDeleteThe rise in the number of homeowners who are underwater on their mortgages has increased so much that a very large number of them have decided that they cannot afford to stay in their homes. royal square

ReplyDeleteMSN Hotmail The best article I came across a number of years, write something about it on this page.

ReplyDelete