If you have bought a flat before or

if you intend to buy one in the future, you always need to know what will be

the total final cost to your pocket! You see those fancy ads by various

developers who talk about rate per square feet of the flat. But we all know

that’s not it. That rate is just tip of the iceberg (more or less). As a buyer we

are more interested to know the total real outgo of money as well as the

breakup to understand what every penny is charged for.

In this article, I have tried my

best to give such a breakup and to arrive at the total price charged from us.

There might be slight variations depending on the city where you intend to buy

your house, but more or less the calculation remains the same. Hope this helps!

Let’s assume:

- Super Built-up Area of the flat – 1200 sqft

- Carpet Area of the flat – 800 sqft

- Basic Selling Price (BSP) – Rs. 10,000 / sqft

- Building – 25 storeys

- Floor rise – Additional Rs. 100 / floor

- Car Parking – Rs. 10,00,000

- PLC (Preferential Location Charges) – Rs. 50 / sqft

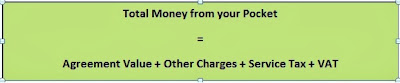

Then Agreement Value is the sum of 3) + 5) + 6) + 7)

Let’s assume we book a flat on the

20th floor

So,

- Agreement value = 10,000 + (20-1)*100 + (10,00,000 / 1200) + 50 = 12783/sqft

- Other Charges = Club development + maintenance (2 years advance) + water meter + electricity + cooperative society share money + fire protection fund + Internal Development Charges (IDC) + External Development Charges (EDC) + Stamp duty + Registration charges

Registration charges = Rs. 30,000 or other as applicable

- Service Tax = 3.708% (for agreement value > 50 lakhs) of Agreement Value + 12.36% of other charges

- NOTE: Most developers do not include Floor rise, PLC and Club development in the Basic APR. As a result, you end up paying higher service tax of 12.36% on it's value. If the developer had included these in the basic APR you would have paid just 3.7% of tax. Any guesses on why a builder does not include these in their basic price? Because then the price quoted in all advertisements would look higher that would dissuade their customers. And this comes at the cost of us paying more money. Feeling duped, are you??

- VAT = 1% of Agreement Value

Now,

Next time when you go to enquire about your new house, I am

sure you will be better informed to get the hidden value of the flat too. It

always pays to be an informed customer. J

No comments:

Post a Comment